Being a movie buff, I end up watching almost every Hindi movie that hits the theater. Bollywood films always leave a great impact on me. They make me feel happy, sad, emotional and excited all at the same time. No matter in which genre it fits, Hindi films also give valuable lessons. While some offer ideas on fashion and styling, others give proposal ideas to youngsters. But what if I say some Bollywood movies give valuable financial lessons, would you believe me? Here is a list of films that you may have watched multiple times but missed their valuable financial lessons. Get some popcorn before you start reading!

1. Baghban: This film is a perfect example of miscalculated retirement planning. The lead actor Raj Malhotra (Amitabh Bachchan) spent everything, including provident fund and gratuity, on education and other needs of his four sons. But when he retired, he had nothing to back him up, and none of the sons was ready to look after him and his wife. Taking a lesson from the film, we should always do an early retirement planning instead of relying on our children. With longevity increasing in the country and rising medical inflation, the need to do retirement planning has increased. Further, the amount received from the employee’s provident fund may not be sufficient to sustain a longer life.

In the past few decades, there has been a cultural shift in the country with the emergence of nuclear family culture. Many retirees don’t prefer to depend on their children for expenses. Many times, children also refuse to support their retired parents financially. Maintaining an independent and relaxed lifestyle is sustainable only if it is carefully backed with a financial cushion.

In reality, retirement depends on how much savings you have made during your earning years. During young age, you can invest for a long time and opt for the higher equity to ensure good returns. In this way, without burning a hole in your pocket, you will be able to accumulate a huge retirement corpus.

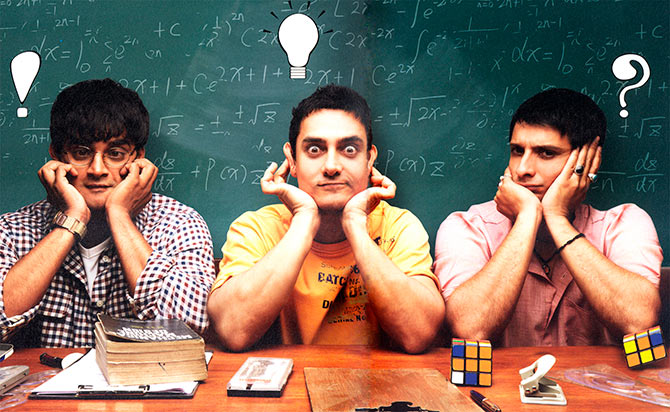

2. 3 Idiots: Raju Rastogi, (Sharman Joshi) came from a low-income family. His father was a postman but in an accident, his limbs got completely paralyzed and as a result, he lost his job. The family was dependent on the meager income of his mother which was not enough to fund household and medical expenses. Raju wanted to take the responsibility of his family and therefore, he was working hard to become an engineer and land a lucrative job. However, his miserable financial state made him emotionally weak and at one point of time, he even attempted to commit suicide.

The destiny of Raju’s family would have been different if his father had bought a term plan, offering complete coverage against disability and critical illness. But due to his poor state, Raju’s father never thought to buy a term insurance. However, since you are drawing a decent income, you should buy a term insurance plan without a second thought. The plan will ensure the financial stability of your family in your absence. Also, the rising number of critical illness cases in India has made it important to buy a term insurance plan with critical illness cover. According to the report of the World Health Organization (WHO), cancer incidence will rise five-fold in India by 2025. When a major ailment strikes, it not only means hefty medical expenses, but it also puts immense pressure on the family to manage their livelihood while the patient recoups. Whether rich or poor, a serious ailment can wipe away years of savings. During such times, critical illness benefit comes to your help. Such type of policy pays a lump-sum amount in case the insured is diagnosed with a critical illness, such as cancer, kidney disease, paralysis, and heart ailments. The insurer pays a lump sum amount on diagnosis of a critical illness which not only covers hospitalization expenses but also acts as an income replacement to meet family’s daily expenses, such as loan EMIs, child’s school fees, and credit card payments. Instead of opting for a separate term insurance plan and critical illness cover, you can get twin benefits under the same policy. For instance, ICICI Pru’s iProtect offers death benefits and also pays a lump-sum amount in case of a critical illness. It also waives off future premiums in case of permanent disability and the policy continues to offer coverage without premium.

3. Deewar: Vijay and his brother endured a lot after the demise of their father. Even due to the shortage of funds, Vijay had to stop his education in the mid-way and in the process of fighting for the family’s rights, he became a smuggler.

No matters how much you have saved over the years, unforeseen circumstances, such as death, affect the family both financially and emotionally. Vijay’s father was not financially strong, and hence, he did not buy a term plan, however since you are working and drawing a decent salary, you must not repeat the same mistake of ignoring a term policy. A term policy ensures that your family continues to enjoy a life without any financial worries even in your absence. After your death, the insurer will pay death benefits which can be utilized by your family for child’s education and other household expenses.

4. Bhaag Milkha Bhaag: Besides showing the life of the legendary athlete, Milkha Singh, the film also gives a brilliant message of how important it is to set goals in life. In the film Farhan Akhtar, as Milkha Singh is seen running in different stages of his life to accomplish various goals. First as a young Milkha, he runs in hot sand from school to reach his home early. Then in Army, Milkha runs in a cross-country race to get a glass of milk and eggs. Last but not the least, Milkha keeps running across the globe to win races and make India proud.

Similarly, it is pertinent to set different goals in life and then create a financial plan to achieve them. Here, your goals could be saving to buy a new house, planning for children’s education, or simply for leading a peaceful life after retirement.

Be the real hero of your family!

We all dance to Hindi songs and try to emulate styles of our favorite Bollywood stars. As a hero protects his loved ones from a villain, we should also buy insurance to safeguard our family from life’s adversaries. Further, like movie tickets, it is possible to buy insurance and investment products with a click of the mouse.